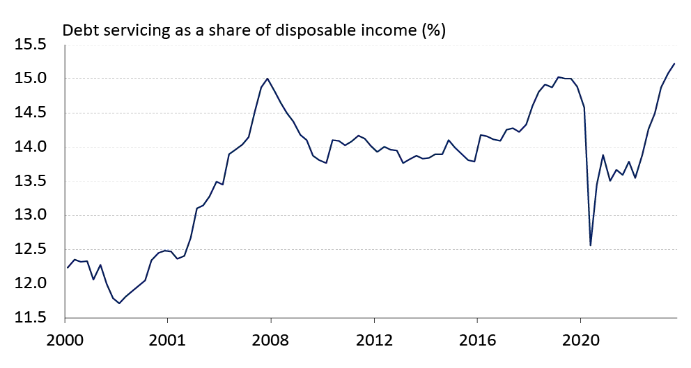

FCC says this is evident in sectors like consumption spending and debt servicing, which are crucial for nearly 60% of the GDP.

Canadian consumers under pressure

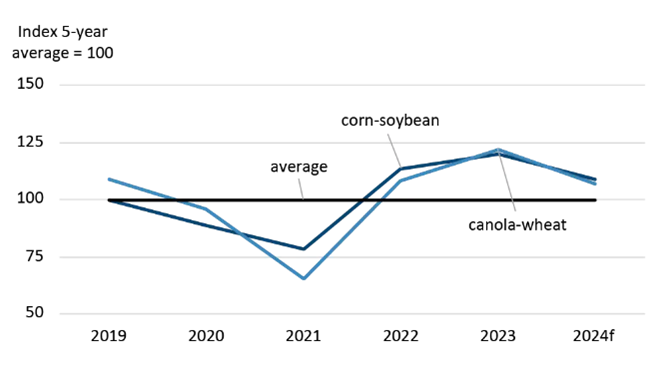

The agricultural sector, however, shows resilience and adaptability. A notable crop achievement is the record-breaking canola crushing in the first quarter of the 2023/24 marketing year. Despite rising construction costs and tight supplies, the sector’s capacity expansion indicates a potential shift in crop cultivation preferences, influenced by the global soybean-corn futures ratio.

Canola crush in the first quarter of marketing year (Aug-Sep-Oct)

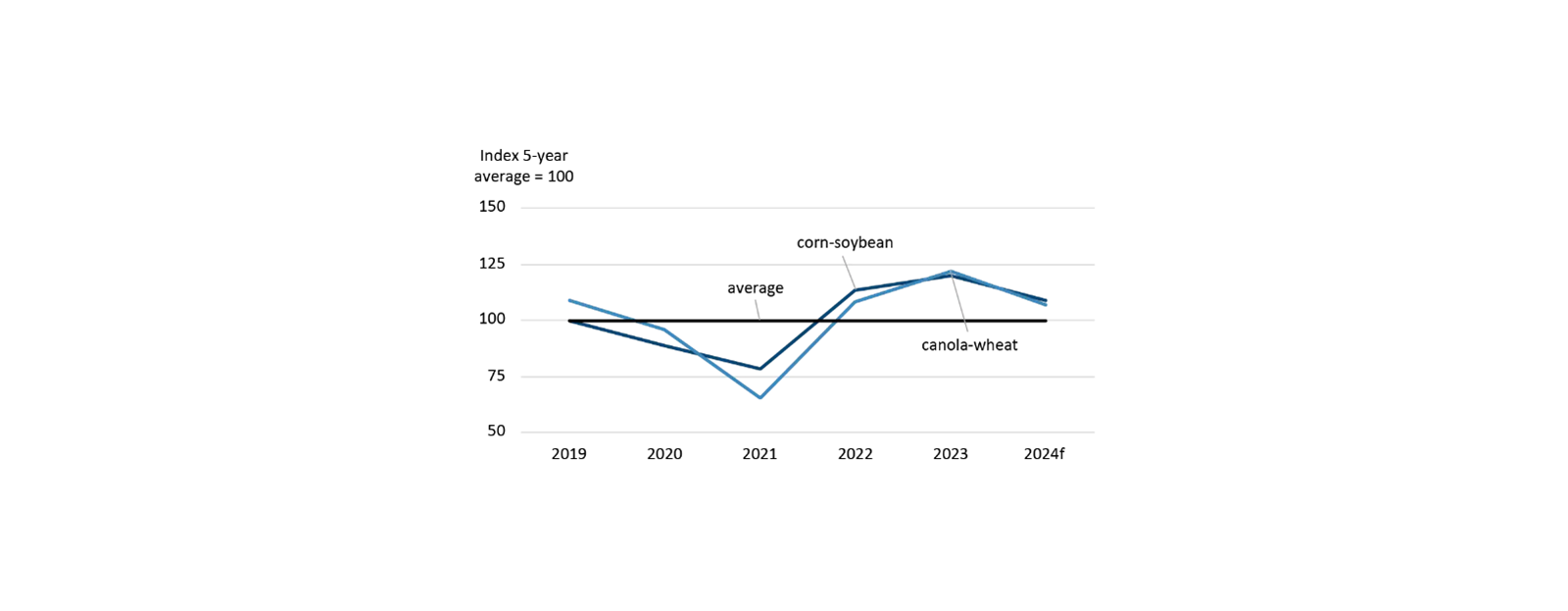

Fertilizer affordability yield

Regarding farm inputs, fertilizer affordability is a key area to watch. The fertilizer affordability index shows improvement, indicating a potential increase in crop profitability for the coming year. This is especially relevant for crops like spring wheat, canola, and corn.

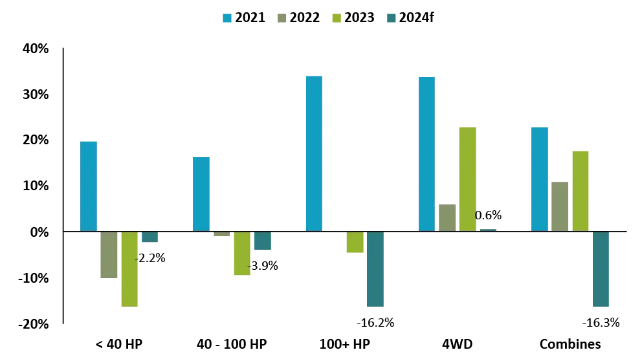

Farm equipment sales might face a downturn, influenced by high borrowing costs and recent supply chain disruptions. While supply issues are being resolved, the industry must adapt to changing economic conditions and farmer purchasing behaviours.

Farm equipment sales are projected to slow in 2024

Canadian agriculture in 2024 is a landscape of challenges and opportunities. From economic headwinds affecting consumption and inflation to sector-specific trends in crops, livestock, and farm equipment, stakeholders need to navigate these dynamics carefully to ensure sustainable growth and profitability.

Chart credits: FCC